What is Deposit and Loan Participation?

A marketplace of investment opportunities within our network. It functions as a catalyst for communication between our credit union partners, involving all sides of the loan-to-share spectrum.

Notre Dame Federal Credit Union

Publication Date: 08/01/2025

Details

New self-storage commercial loan to refinance borrowers current construction loan at a competing bank and buy out existing partners on the project. Borrower has 20+ years of experience in the self-storage industry, owning multiple other self-storage units.

Total loan: $11,000,000 (NDFCU to hold $7M)

Gross Yield: 5-year UST + 275 bps, fixed at closing (rate as of 7/25/25: 6.70%)

Servicing: 0.25%

DSCR: 1.2

Interested parties can contact Robert Shane at rshane@notredamefcu.com.

AdventHealth Credit Union

Publication Date: 03/22/2024

Details

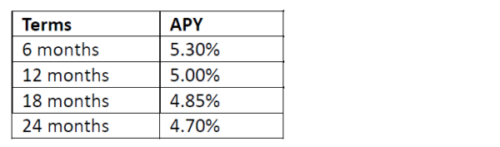

AdventHealth Credit Union is seeking participants for Certificates of Deposit with four terms available. All four terms include deposit minimums at $100,000 and maximums of $500,000.

See table below for current rates:

Excess Share Insurance insures funds up to $500,000.00.

AdventHealth CU is a Low-Income Designated (LID) credit union & has utilized non-member deposits as a funding source for more than 5 years. For more information, please contact Adam Neusaenger at adam.neusaenger@adventhealth.com.